Put yourself in Najib's shoes! ....no...do not look at me incredulously and ask why should you do so! Just for a moment...put yourself in Najib's shoes.

You have just woke up in your official residence - Seri Perdana and your FLOM (Fattest Lady of Malaysia) is also stirring beside you.

Now first up....who wants to wake up beside Rosmah?

Seriously...WHO WOULD WANT TO WAKE UP BESIDE HER?

Now do you see where we are heading to?

The first thing that Najib sees in the morning is Rosmah! Would you wish that even upon the worst of your enemy? Surely not! So this poor idiot wakes up to this nightmare of a wife! Do you not pity him already?

Now what comes next?

Let us skip the image of Najib and Rosmah getting themselves ready for the day...why? Aiyah two old fat fuddies walking around in their underwear going from bed to bathroom is not a pretty sight to behold...what more to wax lyrical upon....so I am not even going to try.

We go next to the breakfast table.

By now Najib has started to figure out that the rest of the day is not going to be easy....!

He has been briefed that Bank Negara has not only revoked approval for 1MDB Rm7.5billion fund transfer but Bank Negara has also issued a directive under

the Financial Services Act 2013 to 1MDB to repatriate the amount of

US$1.83 billion to Malaysia and to submit a plan for that purpose.

Now this news alone is enough to make him wet his pants - even while sitting at the breakfast table...so he has to excuse himself and go change his trousers...the first of many changes that is still to come for the rest of the day as more bad news come his way!

Then even as he is changing his trousers along comes Rosmah to talk to him about the next trip to Milan to do the next Islamic Fashion Show...even though it is still a year away!

And that wise saying of Confucius must surely come to him : "Foolish man give wife trip to Milan, wise man give wife a "good one!" Nudge nudge, wink wink!

Now all this is happening even before Najib leaves the house for his office....so do you not pity him just a little bit?

More to come:

Latest from Sarawak Report:

How Arul Kanda Lied To The 1MDB Board About ‘Cash In The Bank’ — EXCLUSIVE!

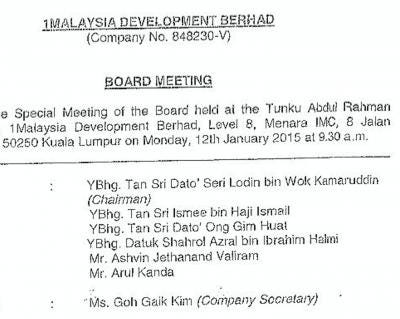

Sarawak

Report has obtained minutes of a 1MDB board meeting, which prove that

CEO Arul Kanda’s claim about ‘cash in the bank’ at BSI Bank Singapore

was not an unfortunate ‘miscommunication‘, but part of a deliberate strategy of misinformation.

In other words, it was a bare-faced and extended lie.

Bank

Negara Malaysia is plainly aware of this situation, given its

statements challenging the Attorney General’s attempts to close down

investigations into 1MDB over the past few hours. It raises further

concerns over the refusal by Najib’s inner circle to accept that

billions were stolen, triggering an unprecedented cover-up by the fund.

Sorry I ‘miscommunicated’

In April Sarawak Report produced evidence

from the Singapore authorities showing there was in fact no ‘cash’ in

1MDB’s BSI bank account. It forced Kanda into a series of retractions

over parliamentary statements made by the Minister of Finance, Najib

Razak, claiming that US$1.103 billion redeemed “in cash” from the

PetroSaudi joint venture had been paid into the fund’s BSI Bank,

Singapore account.

“As the president of the company, I take full responsibility for this misunderstanding, and will ensure better communication with all stakeholders,” [Arul Kanda}

Kanda

“clarified” that the assets held at BSI were in the form of ‘units’,

which Sarawak Report has established are categorised as ‘level 3′,

meaning there is no guarantee as to their actual worth (if any).

Yet,

we have now obtained minutes from a 1MDB board meeting in January,

which make plain that the new CEO had given detailed assurances to Board

members that there was indeed ‘cash’ in the so-called Brazen Sky

account at BSI bank.

He

even gave a highly unbelievable excuse as to why, instead of using

these alleged cash funds, 1MDB was borrowing even more money to cover

its pressing expenses. He made the claim in response to concerns by the

Chairman, Lodin Wok Kamaruddin, that the management had publicly

promised to repatriate the money and then failed to do so:

Why we can’t ‘repatriate’ the cash

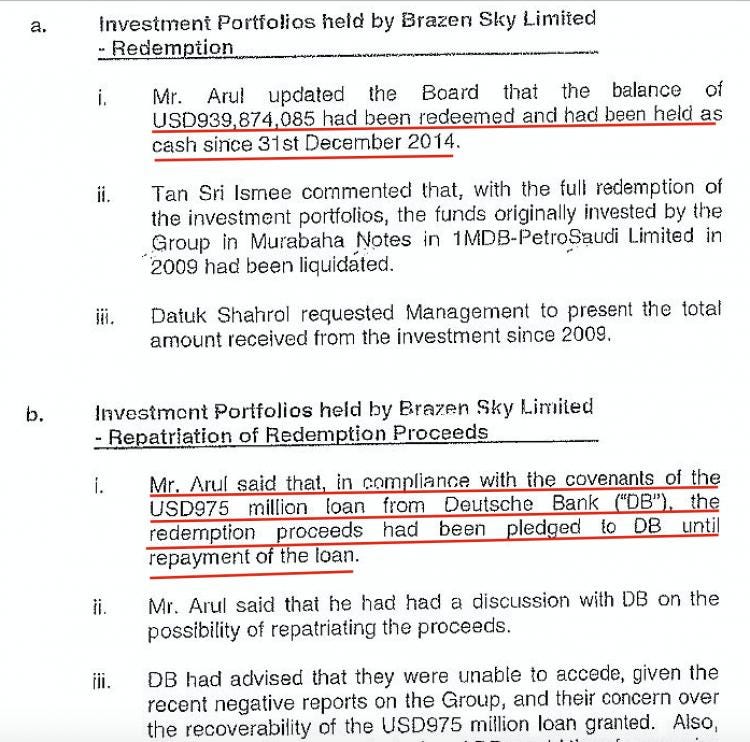

According

to the above minutes, Arul Kanda’s excuse for not repatriating the

‘cash’ was that it had to be retained in the bank in Singapore in order

to guarantee another loan by Deutsche Bank.

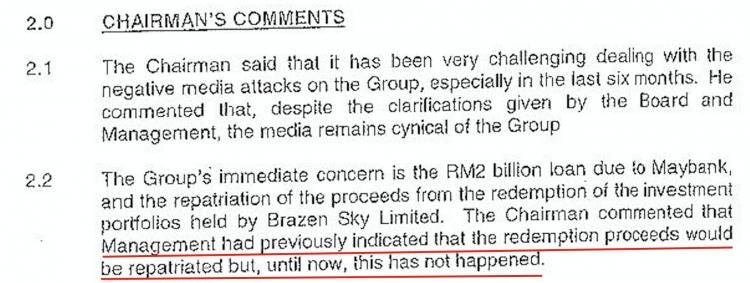

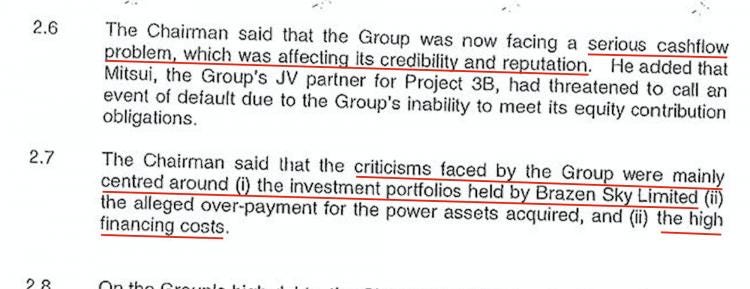

Board

members had just acknowledged that 1MDB was experiencing serious cash

flow and credibility problems, just as the company was planning to try

and get out of its difficulties by issuing shares on the stock market.

And

Lodin Wok Kamaruddin wanted to know why the management had failed to

carry out its pledge to use the alleged remainder of the Cayman Island

(Brazen Sky) fund, which was supposed to contain the ‘profits’ from the

investment into PetroSaudi back in 2009–12.

Why not bring back the money board members asked?

Arul

Kanda’s answer is not only barely credible under the circumstances, it

shows a double deception that could only have been intended.

The

CEO had told his bemused board members that Deutsche Bank was

preventing him from re-patriating the money, because they were demanding

he keep the Singapore cash account as collateral for another almost

identical sum of US$975 million they had loaned to 1MDB.

Surely,

it was nonsensical to keep money in the bank to guarantee the borrowing

of a virtually identical amount, especially when the ‘high financing

costs’ had become a key concern at the fund?

This

was not a communication slip by Kanda, it was a positive claim that the

assets were being held in cash, because the lending bank consortium

would accept nothing less to guarantee their further loan.

There

is another strange issue thrown up by these January minutes. In public

statements 1MDB had claimed there was US$1.103 billion in the BSI Brazen

Sky account, yet Kanda informed the Board there was only US$939 million

over a hundred million less.

The

excuse about Deutsche Bank also contradicted Arul Kanda’s public

statements that the money was not being repatriated because it would be

to expensive to bring the money back.

It appears that no one on the board saw fit to raise a query over such obvious matters.

Yet,

Sarawak Report suggests there is only one credible explanation for all

these twists and turns, which is that Kanda could not repatriate and use

the alleged ‘cash’, because there was no cash — merely level 3 assets

representing ‘units’ of zero value in a fund managed by Hong Kong’s

shadowy Bridge Partners based in the Cayman Islands.

That

the Board accepted his feeble excuse that close to a billion dollars

had to remain frozen in Singapore, in order to guarantee a further

billion dollar loan from Deutsche Bank means either they were

half-witted or they had decided to turn a blind eye to a desperate

situation caused by blatant corrupted management of the fund.

Shahrol Halmi knew the truth

Sarawak

Report suggests that the board members were not financially illiterate

half-wits and that they knew full well that the fund had been mismanaged

on their watch.

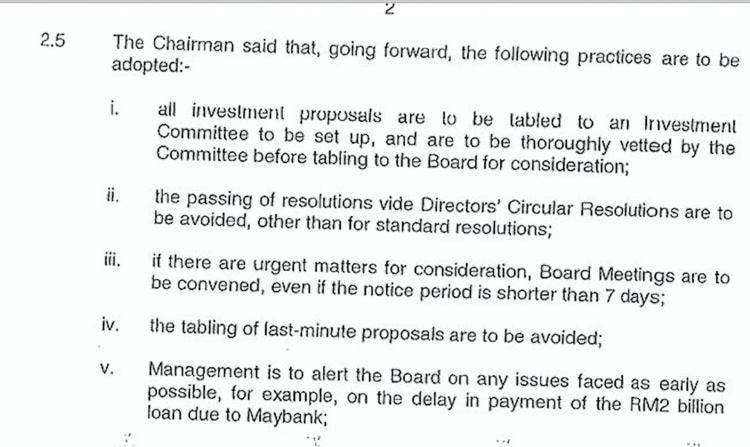

This

is born out by further evidence from the leaked minutes in our

possession, which show that the meeting began with complaints by board

members that past decisions had not been made with the proper consent

and oversight of the Board.

There

was a resolution therefore to change procedures to ensure that in

future all investment decisions would be properly considered.

After all, they were talking about billions of dollars of public money!

Poor oversight by the Board — so who was making all the investment decisions at 1MDB?

Now that we are RM42 billion in the red perhaps we should start doing things properly going forward?

These

resolutions and the willingness to nevertheless accept Arul Kanda’s

barmy logic of leaving a billion in the bank to guarantee a further

billion worth of borrowing show a staggering level of negligence by a

board that can only have known better.

Someone

else who can only have known better was another vocal member of the

1MDB board whose comments are also registered in these revealing minutes

of January 2015.

This

was none other than the fund’s former Chief Executive, Shahrol Halmi,

who knew exactly why there was no actual money in BSI’s Singapore

accounts.

It

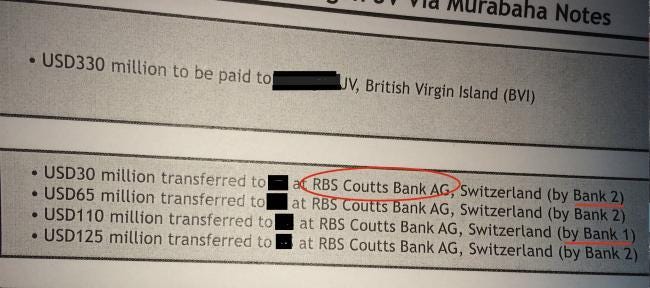

was he, after all, who had presided over the theft of US$700 million

from 1MDB back on day one of the so-called 1MDB PetroSaudi joint

venture. He had likewise signed off two further major ‘loans’ to

PetroSaudi — US$500 million in September 2010 and then US$330 million

that went straight from 1MDB into the Jho Low company Good Star Limited in 2011, according to documents obtained by Sarawak Report from the Bank Negara investigations into investments by the fund.

These

payments total US$1.83 billion, which significantly represents the sum

referred to by the Chief of Bank Negara Zeti Akhtar Aziz when she issued

a damning statement on Thursday condemning the Attorney General’s

refusal to issue proceedings against the theft.

Yet

Halmi had the bare-faced cheek to ask on behalf of the board for his

successor Arul Kanda to “present the total amount received from the

investment since 2009″!

No mystery

There is, of course, no longer any mystery as to where the PetroSaudi investment money went between 2009 and 2011.

And

it has been clearly proved how there was nothing whatsoever ‘redeemed’

from the partnership in 2012 and therefore no money to ‘invest’ in a

so-called Special Purpose Vehicle in the Caymans.

Documents,

retrieved by Sarawak Report and now in the hands of several

international financial regulators, make absolutely plain that all the

money paid out from 1MDB’s alleged Saudi joint venture went to Jho Low’s

Good Star Limited; the buy out of the UBG group (in which Jho Low had

shares along with Taib Mahmud); pay offs to Jho Low’s co-conspirators at

PetroSaudi International and injections of cash into PetroSaudi itself.

The eventual shadowy sale of 1MDB’s so-called investment in PetroSaudi was therefore nothing more than a blatant sham.

The

third party ‘purchaser’ of this interest, who allegedly paid US$2.3

billion to 1MDB in 2012, enabling Najib to trumpet that fund had made a

profit from the venture, was eventually revealed to be none other than

the barely known Bridge Partners, an outfit based in Jho Low’s home base

of Hong Kong.

1MDB

then engaged the very same Bridge Partners themselves to purportedly

manage the ‘cash fund’ in its ‘segregated portfolio account’ in the

secretive Cayman Islands!

No

wonder 1MDB subsequently found it impossible to persuade even its

compliant auditors KPMG to sign off its 2013 company accounts. There

were months of delay, during which as Shahrol Halmi wrangled with a new

team from Deloitte to sign through the deal.

It

has finally emerged that Deloitte finally agreed to ratify these

painfully delayed accounts only after Jho Low’s new best friends from

Abu Dhabi’s Aabar fund agreed to place a guarantee on the value of the

Cayman Island Brazen Sky account.

1MDB’s

subsequent hugely expensive dealings with Aabar itself saw the running

up of further enormous and escalating debts through 2012 and 2013, as

the fund sought to pay off its new friends from Abu Dhabi for their

so-called assistance.

Once

again Aabar/ IPIC has come in to temporarily rescue Malaysia’s

beleaguered fund as its sole shareholder and ultimate decision-maker

seems hell bent on digging ever deeper holes in the Malaysian economy in

order to rescue his own political position.

Originally published at www.sarawakreport.org.

No comments:

Post a Comment