Lynas first half loss widens to $103.5m

- AAP

- March 13, 2015

RARE earths miner Lynas Corporation has almost doubled its half year

loss as it looks to cut more costs in a difficult market.

LYNAS is carrying out a review of its operations and making changes

to its debt agreements as it focuses on growing its market share.The company is cutting general and administrative expenses and implementing efficiency gains such as closing its Sydney operations and increasing production recovery.

Lynas recorded a first half loss of $103.5 million to December 31, 2014, after a $59.3 million half year loss a year ago.

Rare earths prices have sunk as supply has increased and hi-tech

product users have become more efficient and found alternative sources

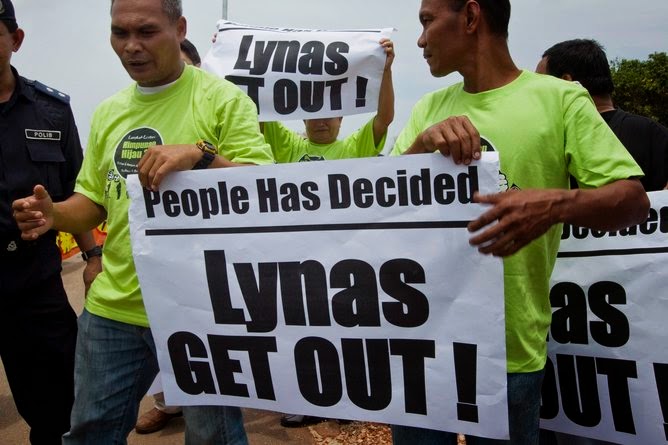

to deal with China's stranglehold on world production. Lynas has also struggled to ramp up production and make its Malaysian refinery profitable.

Its shares have fallen more than 80 per cent in the past year after the company made a $366 million full year loss in 2013/14. In the past six months, Lynas' total liabilities have blown out to $650 million, from $550 million in the previous six months.

The ability of the group to pay its operating expenses and the

principal and interest payments due on its debt facilities over the next

12 months would depend on factors such as production volumes, sales

volumes, operating expenses and rare earths market prices, Lynas said.

Lynas chief executive Amanda Lacaze said that through the half year,

Lynas had improved core capabilities and grown customer relationships.

"These continuing improvements have been recognised by our two key debt

providers who have agreed to make changes to our debt agreements to

support the continued growth of the Lynas business," Ms Lacaze said.

Revenue was $65 million in the first half, up from $14.6 million in the previous year.

The company did not declare a dividend.

Lynas shares were down 0.25 cents, or 4.9 per cent, at 4.9 cents.

No comments:

Post a Comment